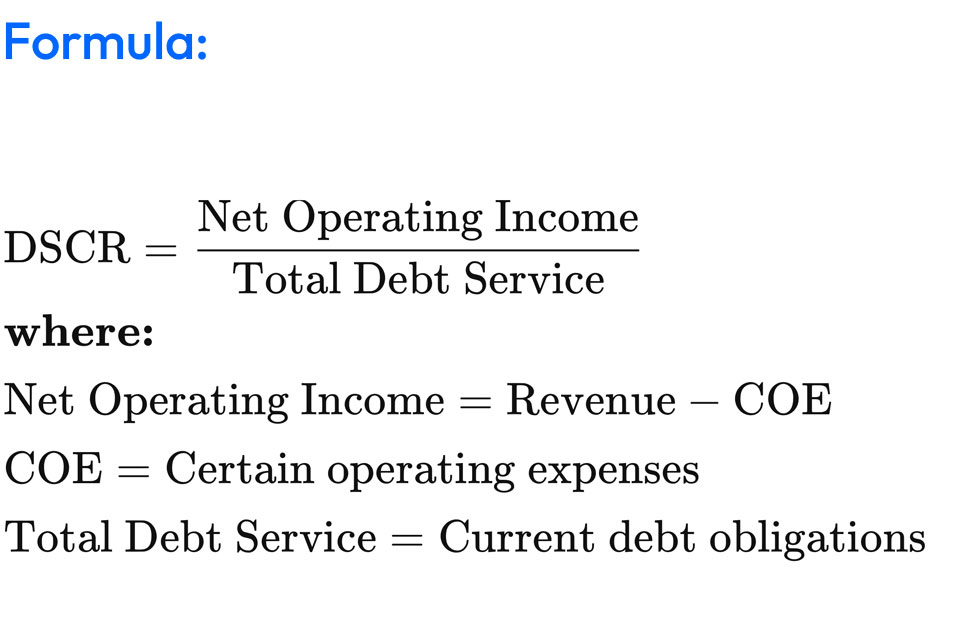

Debt Service Coverage Ratio (DSCR)

DSCR is a metric used by lenders and investors to assess a company's ability to cover its debt payments. It provides insights into whether a business generates enough cash flow to meet its debt obligations, including both principal and interest payments.

Net Operating Income (NOI)

Calculation: NOI is derived by subtracting operating expenses from operating revenues. It represents the cash generated by the core operations of a business.

Inclusion: Rental income, gross income, and other revenue streams contribute to NOI.

Total Debt Service

Components: Total Debt Service includes principal and interest payments on loans.

Inclusion: Mortgage payments, interest on loans, and any other debt-related payments are considered.

Interpretation of DSCR

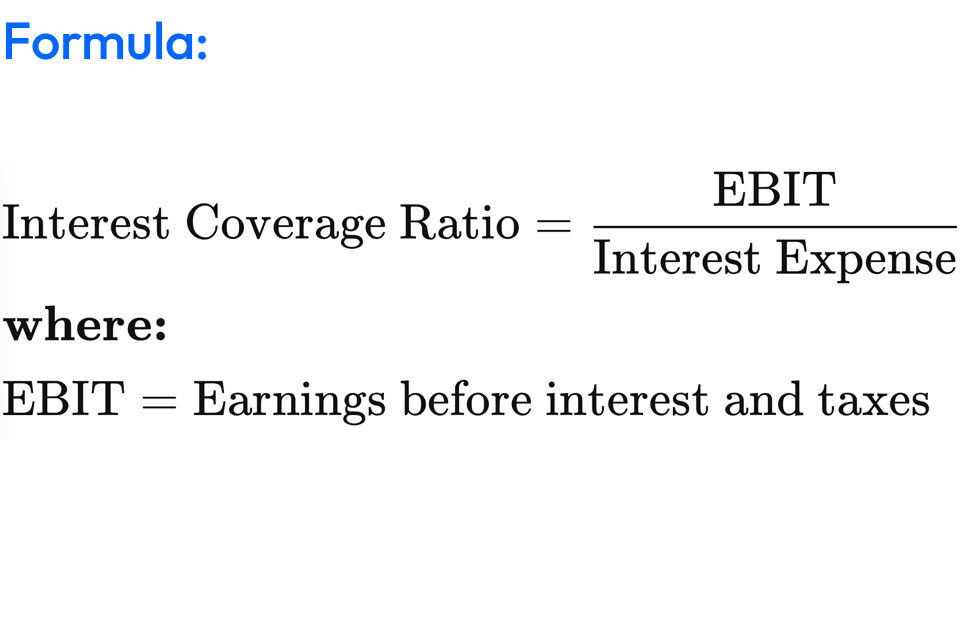

Interest Service Coverage Ratio (ISCR)

While DSCR assesses the ability to cover both principal and interest, ISCR specifically focuses on a company's capacity to meet its interest payments. The formula for ISCR is similar to DSCR, but it considers only the interest component:

Strategic Implications

Lender Confidence:

Higher Ratios: A higher DSCR and ISCR instill confidence in lenders, making it easier for a company to secure financing. but this is not always the case. There is a upper limit and industry specific ideal ratio limits to observe.

Risk Mitigation: Strong ratios reduce the perceived risk of default.

Business Planning:

Proactive Measures: Monitoring DSCR and ISCR guides businesses in taking proactive measures to enhance cash flow and profitability.

Strategic Decision-Making: Insights from these ratios aid in strategic decision-making, such as debt restructuring or refinancing.

In the intricate landscape of financial management, two crucial metrics stand as sentinels guarding a company's ability to meet its debt obligations – Debt Service Coverage Ratio (DSCR) and Interest Service Coverage Ratio (ISCR). Delve into the intricacies of these ratios to fortify your understanding of financial health.