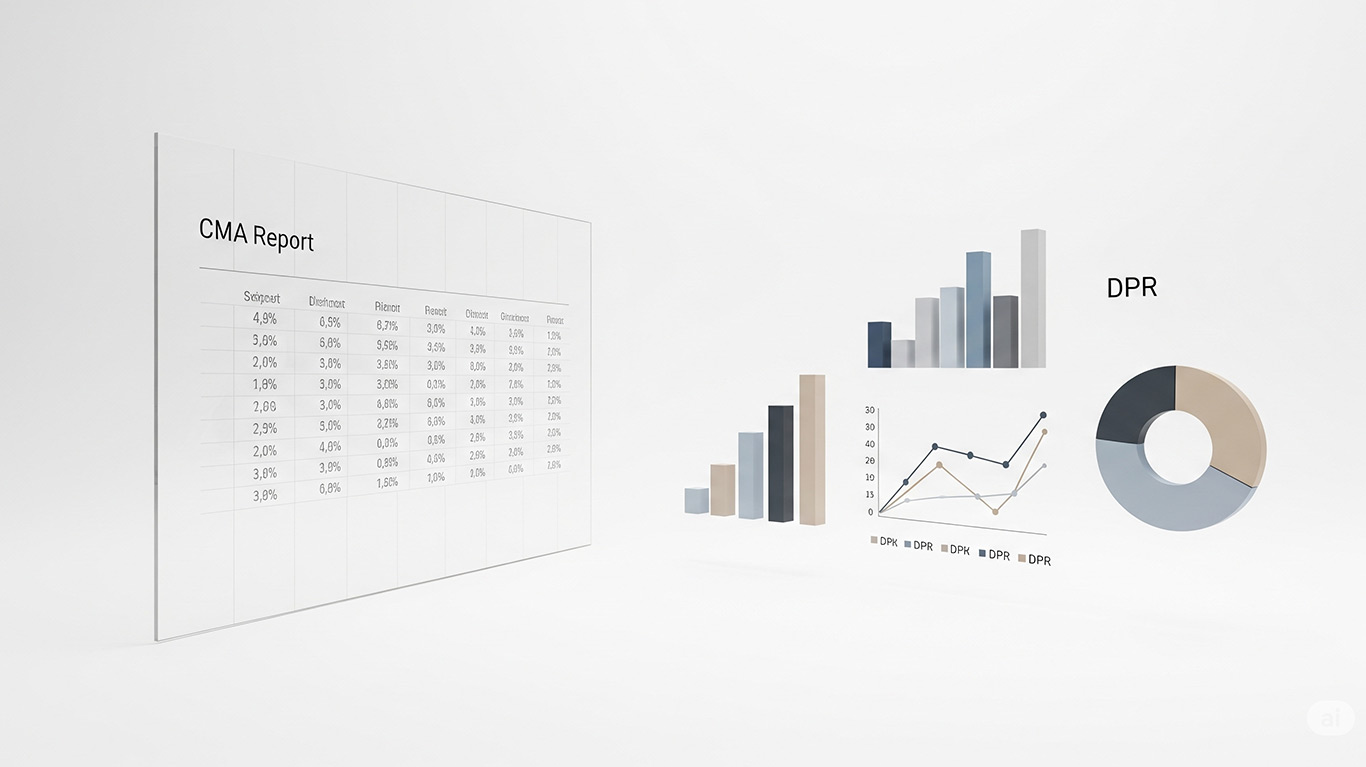

Approved project report format with in-depth CMA Data. Stop waiting for consultants. Create a professional Detailed Project Report (DPR) with complete business profile and Financial Projections with our automated CA system.

- No accounting knowledge required.

- Accepted by all Nationalized & Private Banks in India.

Trusted by 9,20,000+ Entrepreneurs since 2010