Key Differences:

Nature of Metric:

Focus on Profitability:

Comparative Analysis:

Use in Decision-Making:

Why Does EBITDA Margin Matter?

EBITDA margin offers several advantages over traditional profitability measures like net income:

Comparability: By stripping away the influence of financing decisions, taxes, and accounting choices, EBITDA margin allows for fairer comparisons between companies across different industries and even geographic regions.

Operational Efficiency: It sheds light on a company's ability to generate profit from its core operations, independent of external factors. This makes it a valuable indicator of operational efficiency and cost management.

Future Potential: As EBITDA reflects cash flow generation, a strong margin can often point towards a company's ability to handle debt repayments and potentially reinvest in future growth.

Interpreting EBITDA Margin

While there's no one-size-fits-all benchmark for a good EBITDA margin, industry averages can provide context. Generally, higher margins indicate stronger profitability and efficiency. However, it's crucial to consider the specific industry and business model when interpreting the margin.

By understanding EBITDA margin, investors and analysts gain valuable insights into a company's core operating profitability and efficiency. This metric allows for fairer comparisons, sheds light on cost management, and can even hint at future potential. So, the next time you encounter financial reports, remember to look beyond the bottom line and seek the insightful frosting – the EBITDA margin.

EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) and EBITDA Margin are related financial metrics, but they serve different purposes in assessing a company's financial performance.

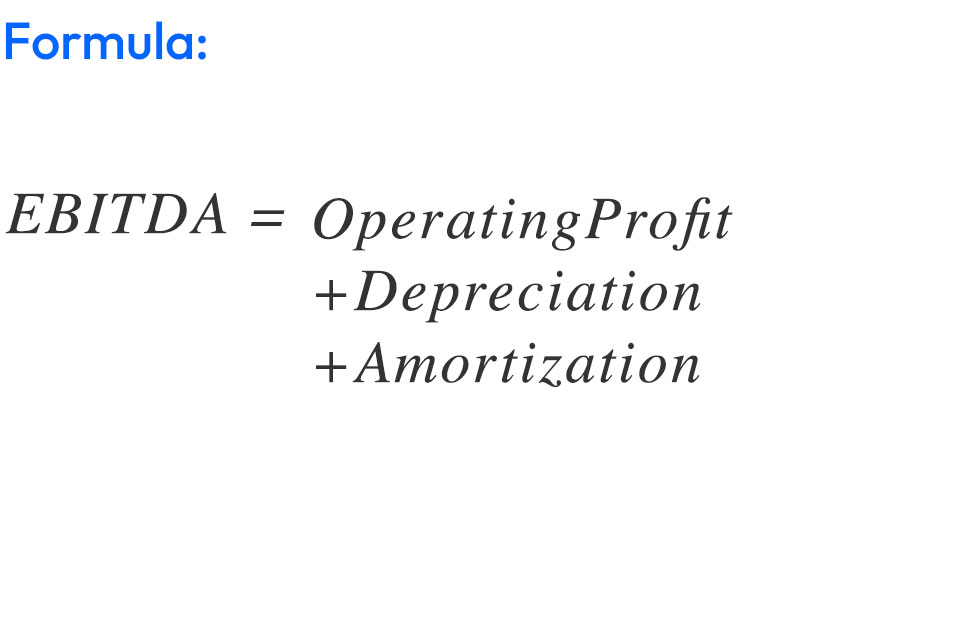

EBITDA = OperatingProfit + Depreciation + Amortization

EBITDA is an absolute dollar amount that represents a company's operating profitability. It measures a company's ability to generate profit from its core operations by excluding certain non-operating expenses. The formula for calculating EBITDA is:

-

Operating Profit: Also known as Earnings Before Interest and Taxes (EBIT), it is the profit derived from a company's core operations before considering interest and taxes.

-

Depreciation and Amortization: These are non-cash expenses that account for the reduction in value of assets over time. Excluding them provides a clearer picture of cash flow from operations.

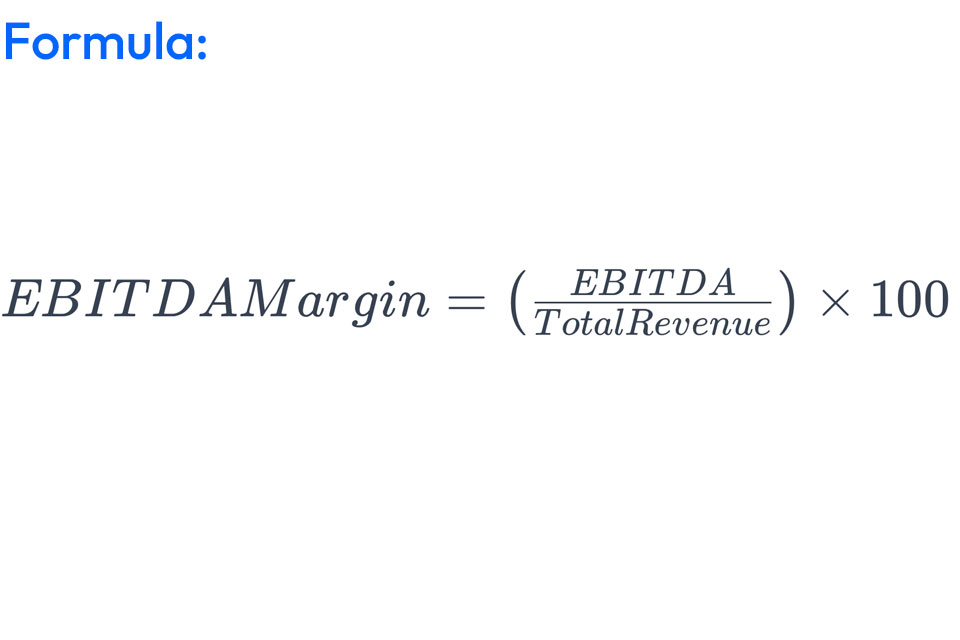

EBITDA Margin

EBITDA Margin, on the other hand, is a ratio expressed as a percentage. It represents the proportion of a company's total revenue that translates into EBITDA. EBITDA Margin is a profitability margin, providing insights into how efficiently a company converts its revenue into operating profit.

EBITDA: Earnings Before Interest, Taxes, Depreciation, and Amortization

Imagine a company's financial performance as a delicious cake. EBITDA represents the cake itself, before we slice off pieces for things like interest payments, taxes, and non-cash expenses like depreciation and amortization. These deductions can vary significantly between companies and even industries, making it difficult to directly compare their bottom lines (net income).

EBITDA Margin: The Efficiency Gauge

This is where EBITDA margin comes in. It's like the frosting on our cake – a percentage that reveals how much of every dollar earned from core operations translates into actual profit. It's calculated by dividing EBITDA by total revenue and expressed as a percentage.