The Credit Monitoring Arrangement (CMA) in Indian Banking: From Regulatory Cornerstone to a Component in a Modern Appraisal Ecosystem

Executive Summary

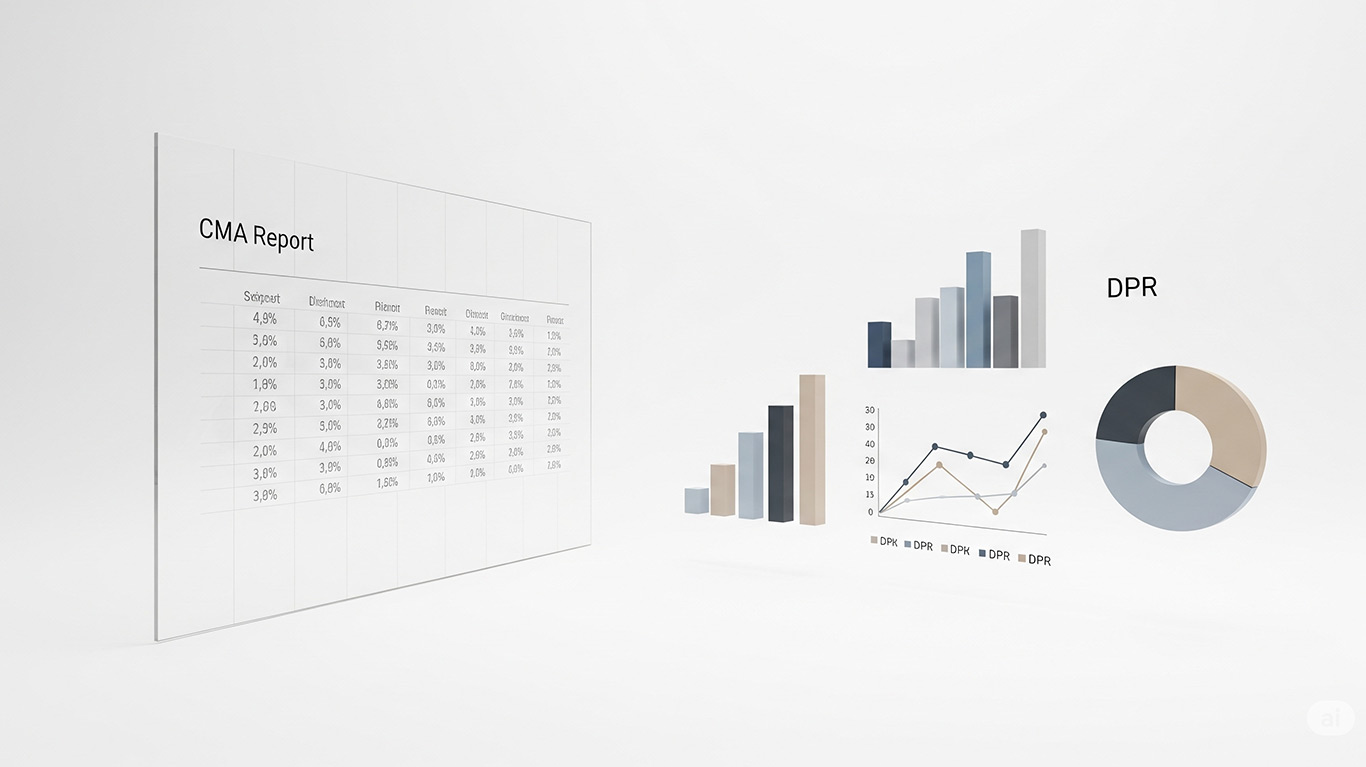

This report provides a comprehensive analysis of the Credit Monitoring Arrangement (CMA) data framework, a standardized credit appraisal tool integral to the Indian banking sector. It traces the historical origins of the CMA, clarifying its development from the recommendations of the Tandon and Chore Committees and its implementation in 1988 as a successor to the more rigid Credit Authorisation Scheme (CAS). The analysis deconstructs the core components of the CMA report, elucidating its function as the primary quantitative tool for assessing a borrower's financial health, particularly for working capital finance. The report critically examines the relationship between the CMA data and the Detailed Project Report (DPR), establishing their distinct yet complementary roles in the loan appraisal process. It addresses the contemporary observation that the importance of CMA data has declined, reframing this perception not as a sign of obsolescence, but as a reflection of its evolution. The CMA has transitioned from being the standalone determinant of creditworthiness to a foundational quantitative component within a more holistic, qualitative, and forward-looking modern credit appraisal framework. This evolution has been significantly influenced by the post-1991 economic liberalization, which necessitated a greater focus on business strategy and market viability, and is now being further shaped by the rise of FinTech and alternative data analytics. The report concludes with strategic recommendations for loan applicants and a synthesis of the past, present, and future of credit appraisal in India, positioning the CMA as a durable but evolving element in a sophisticated risk management ecosystem.

Deconstructing the Credit Monitoring Arrangement (CMA) Data Framework

The Credit Monitoring Arrangement (CMA) data report is the foundational quantitative document in the dialogue between a corporate borrower and a lender in India. It is not merely a collection of financial statements but a structured and standardized analytical tool designed to provide a comprehensive view of a company's financial standing.

The Purpose and Mandate of CMA Data

The primary purpose of a CMA report is to enable banks and financial institutions to conduct a systematic and detailed analysis of a borrower's creditworthiness. Its core function is to assess the borrower's repayment capacity by examining the historical and projected flow and application of funds within the business, thereby helping the lender to understand the inherent risks and make an informed lending decision. In line with guidelines from the Reserve Bank of India (RBI), the submission of a CMA report is a mandatory part of the loan application process for most business loans, including project loans, term loans, and working capital facilities like cash credit and overdrafts. While almost universally required for business credit, it is especially critical for loan exposures exceeding certain thresholds, such as ₹10 Lacs, with significantly greater scrutiny applied to proposals for amounts above 2 crores.

Anatomy of the CMA Report: A Form-by-Form Analysis

The standardized structure of the CMA report is its defining feature. It creates a cohesive narrative that connects a company's past performance with its future ambitions. This is achieved by collating and analyzing financial data across a specific timeline, typically comprising two years of audited historical figures, the current year's provisional or estimated figures, and projections for the next three to five years. This structure is organized into a series of forms or statements, each serving a distinct analytical purpose.

Form I: Particulars of Current & Proposed Limits

This is the introductory statement that sets the context for the entire appraisal. It details the borrower's existing credit facilities, distinguishing between fund-based limits (e.g., Cash Credit, Working Capital Term Loan) and non-fund-based limits (e.g., Letters of Credit, Bank Guarantees). It includes information on the sanctioned limits, their historical utilization, and the new or enhanced limits being requested by the borrower.

Form II: Operating Statement (Analysis of Profit & Loss Account)

This statement provides a detailed analysis of the company's operational performance. It presents a comparative view of past and projected revenue from sales, the cost of sales, gross profit, operating expenses, and ultimately, the profit before and after tax (PBT and PAT). This form is designed to be a scientific assessment of the business's core profit-generating capacity and operational efficiency.

Form III: Analysis of Balance Sheet

This form offers a static yet crucial snapshot of the company's financial position at different points in time. It analyzes the composition and value of current and non-current assets against current and non-current liabilities. This analysis is fundamental for assessing the firm's tangible net worth, its capital structure (i.e., the mix of debt and equity), and its long-term solvency.

Form IV: Comparative Statement of Current Assets & Current Liabilities

Focusing specifically on short-term financial management, this statement provides a granular breakdown of the components of working capital. It compares the levels of inventory, sundry debtors (receivables), and other current assets against sundry creditors (payables) and other current liabilities. This allows the banker to assess the borrower's liquidity position and the efficiency of its operating cycle.

Form V: Calculation of Maximum Permissible Bank Finance (MPBF)

Historically, this was the cornerstone of working capital assessment in India. Based on the methodologies proposed by the Tandon Committee, this form calculates the maximum amount of working capital finance a bank can extend. It is derived from the "working capital gap" (Current Assets less Current Liabilities other than bank borrowings) and the borrower's required margin contribution. This calculation directly addresses the borrower's capacity to borrow and ensures that bank finance acts as a supplement to, not a replacement for, the borrower's own funds.

Form VI: Funds Flow Statement

This dynamic statement tracks the movement of funds within the business over a financial year. It details the various sources from which funds were generated (e.g., net profit, depreciation, infusion of capital, new long-term loans) and the application of those funds (e.g., purchase of fixed assets, repayment of term loans, payment of dividends). A critical function of this statement is to help the banker identify any potential diversion of short-term working capital funds for long-term uses, which is considered a sign of financial indiscipline.

Form VII: Ratio Analysis

This final section serves as an analytical dashboard, synthesizing the raw data from the preceding forms into key financial ratios. These ratios provide a quick, standardized, and comparable summary of the firm's financial health across several dimensions:

- Liquidity Ratios (e.g., Current Ratio, Quick Ratio) to measure the ability to meet short-term obligations.

- Solvency/Leverage Ratios (e.g., Debt-Equity Ratio, Total Outside Liabilities to Tangible Net Worth (TOL/TNW)) to assess long-term financial stability and reliance on debt.

- Profitability Ratios (e.g., Gross Profit Margin, Net Profit Margin) to measure operational efficiency and return on sales.

- Efficiency/Turnover Ratios (e.g., Inventory Turnover, Debtors Turnover) to evaluate how effectively assets are being utilized to generate sales.

- Coverage Ratios (e.g., Debt Service Coverage Ratio - DSCR), which are particularly critical for term loan appraisal as they measure the firm's ability to service its debt obligations from its operating profit.

The logical progression from setting the context (Form I) to analyzing performance and position (Forms II & III), applying diagnostic tools (Forms IV, V, VI), and summarizing the results (Form VII) reveals that the CMA is a comprehensive diagnostic process. Its rigid, standardized format creates a common language of risk assessment across the entire Indian banking system, allowing for consistent and comparable evaluation of diverse businesses. This legacy of standardization is a direct outcome of the top-down regulatory environment in which it was conceived.

The Genesis of CMA: A Historical Perspective on Indian Credit Regulation

The Credit Monitoring Arrangement did not emerge in a vacuum. It was the culmination of a multi-decade evolution in the Reserve Bank of India's approach to credit regulation, driven by the need to balance economic planning with operational efficiency. Understanding this history is key to appreciating the purpose and structure of the CMA framework.

The Pre-CMA Era: The Credit Authorisation Scheme (CAS) (1965-1988)

In 1965, the RBI introduced the Credit Authorisation Scheme (CAS) as a tool for direct credit control in a centrally planned economy. The scheme mandated that all scheduled commercial banks obtain prior authorization from the RBI before sanctioning any large credit facility (initially above ₹1 crore) to a single borrower. The primary objective was to prevent the monopolization of scarce credit resources by a few large industrial houses and to align credit allocation with national priorities. However, the CAS proved to be a significant impediment to industrial financing. The requirement for RBI's pre-sanction approval created a bureaucratic bottleneck, leading to inordinate delays that frustrated both banks and their corporate clients. This inefficiency prompted a search for a more streamlined system that could maintain credit discipline without stifling the pace of lending.

The Tandon Committee (1974): Architect of Need-Based Lending

In July 1974, the RBI constituted a study group under the chairmanship of Shri P.L. Tandon to frame new guidelines for bank credit. The committee's report, submitted in 1975, was a landmark that fundamentally reshaped the philosophy of lending in India. Its key recommendations included:

- A Paradigm Shift in Lending Philosophy: The committee's most profound contribution was engineering a shift away from the traditional security-oriented lending to a modern need-based approach. It argued that the true security for a bank loan was a well-managed, viable business, not merely the value of its collateral.

- Introduction of Norms and MPBF: To operationalize this new philosophy, the Tandon Committee introduced two critical concepts:

- Inventory and Receivable Norms: It prescribed specific, industry-wise norms for the maximum levels of inventory and receivables a company could hold. This was designed to prevent excessive build-up of current assets financed by bank credit and to enforce financial discipline.

- Maximum Permissible Bank Finance (MPBF): The committee introduced the concept of the "working capital gap" (defined as total current assets minus current liabilities other than bank borrowings) and proposed three graded methods for calculating the MPBF. The core principle was that bank credit should only supplement a borrower's resources, not be the primary source of finance. The second method of lending became the most widely adopted standard. It required the borrower to contribute a minimum of 25% of its total current assets from long-term sources (equity and term debt), thereby ensuring a minimum current ratio of 1.33:1 and strengthening the company's balance sheet.

The Chore Committee (1979): Strengthening Monitoring and Discipline

Following the Tandon Committee, the RBI appointed another working group in 1979, headed by Shri K.B. Chore, to review the operational aspects of the cash credit system and suggest further refinements. The Chore Committee's recommendations focused on enhancing the monitoring mechanisms:

- Strengthened Information System: It reinforced the Tandon Committee's call for a robust information system by mandating the submission of quarterly financial statements from large borrowers. This allowed banks to monitor actual performance against the projections submitted at the time of loan appraisal, enabling early detection of any financial distress.

- Peak and Non-Peak Level Limits: It recommended that for businesses with seasonal cycles, banks should sanction separate credit limits for peak and non-peak periods, ensuring that credit availability was more closely aligned with actual operational needs.

The 1988 Transition: Implementation of the CMA Framework

The combined recommendations of the Tandon and Chore committees laid the conceptual groundwork for the CMA. In October 1988, the RBI formally discontinued the inefficient Credit Authorisation Scheme and introduced the Credit Monitoring Arrangement. This transition marked a significant ideological evolution in the RBI's regulatory approach. It moved from being a direct approver of credit to a supervisor of the credit appraisal process. The CMA framework delegated the authority for loan sanctioning to the banks themselves, thereby eliminating the delays associated with the CAS. In its place, it established a system of discipline through the standardized CMA data format and a mechanism of post-sanction scrutiny by the RBI for large credit proposals (e.g., working capital limits over 5 crores and term loans over 2 crores). While the exact RBI circular number or a specific Government Finance Ministry GR for this 1988 implementation is not detailed in available documentation, its origin in the Tandon and Chore Committee recommendations and its official start date are well-established.

CMA Data vs. The Project Report: A Comparative Analysis of Appraisal Tools

A central point of discussion in Indian credit appraisal is the distinction and relative importance of the CMA data report and the Detailed Project Report (DPR). While both are essential documents in the loan application process, they serve fundamentally different purposes and answer different questions for the lender. Their relationship is not adversarial but symbiotic, providing a comprehensive, 360-degree view of the credit proposal.

Distinct Objectives: Appraising the Borrower vs. Appraising the Project

The core difference lies in their focus. The CMA report is primarily an inward-looking document. Its objective is to assess the overall financial health, operational efficiency, and historical track record of the borrowing entity itself. It answers the lender's question: "Is this company financially disciplined, operationally sound, and a credible borrower with a proven ability to manage its finances?". In contrast, the Project Report is an outward and forward-looking document. Its objective is to establish the viability of a specific, proposed project for which the loan is being sought. It addresses a different set of questions: "Is this new venture or expansion plan technically feasible, commercially viable in its target market, and projected to be financially profitable enough to justify the investment?".

Application in Loan Types: Working Capital vs. Term Loans

These distinct objectives naturally align each document with different types of financing:

- Working Capital Assessment: The CMA report is the quintessential tool for assessing and sanctioning working capital facilities like Cash Credit (CC) and Overdraft (OD). Its detailed analysis of the operating cycle, liquidity management, and levels of inventory and receivables (as seen in Forms IV and V) is perfectly tailored to determine the day-to-day funding requirements of a business.

- Term Loan Appraisal: The Project Report is the primary document for the appraisal of term loans, which are long-term funds used for capital expenditure. This is especially true for new projects ("greenfield" projects) or significant expansions ("brownfield" projects). The DPR contains critical information absent in a CMA, such as detailed project costs, means of finance, technical specifications of machinery, market analysis, implementation schedules, and profiles of the management team.

A Symbiotic, Not Adversarial, Relationship

The two reports are not mutually exclusive; for most term loan applications from existing businesses, lenders require both. They provide complementary perspectives that, together, create a complete risk profile. The Project Report articulates the future vision and its potential, while the CMA data provides the historical evidence of the management's capability to execute such plans and manage finances prudently. This relationship can be analogized to an investment pitch. The Project Report serves as the pitch deck, showcasing the exciting future opportunity and outlining the strategy to achieve it. The CMA report, on the other hand, is the audited financial history and due diligence package, providing concrete proof of the management team's past performance and financial discipline. A prudent investor-or a banker-will not fund a brilliant idea (a strong Project Report) from a team with a poor or unproven track record (a weak CMA). In practice, this synergy is often formalized. The financial projections section of a comprehensive Detailed Project Report is frequently prepared and presented in the standardized CMA format. This demonstrates how the CMA structure serves as the quantitative engine within the broader, more qualitative framework of the DPR, translating the project's strategic goals into the language of financial viability that banks understand.

| Parameter | CMA Data | Project Report |

|---|---|---|

| Primary Focus | Overall financial health of the borrower. | Viability of a specific project. |

| Time Horizon | Primarily historical (2-3 years) and projected (3-5 years) financial performance. | Primarily forward-looking, from project inception through its economic life. |

| Core Content | Standardized financial statements, ratio analysis, fund flow. | Business plan, market analysis, technical feasibility, management profile, risk assessment, financial projections. |

| Nature | Largely quantitative and standardized. | Largely qualitative and descriptive, supported by quantitative projections. |

| Primary Loan Type | Working Capital Limits (CC, OD), renewal of limits. | Term Loans, Project Finance, loans for new ventures/expansions. |

| Key Question Answered | "Can the company repay a loan based on its established operational track record?" | "Will this specific project generate enough cash flow to be successful and repay its own debt?" |

| Format | Standardized, RBI-influenced format. | No fixed format, tailored to the project and lender requirements. |

The Evolving Role of CMA Data in Modern Credit Appraisal

The assertion that CMA data now holds "low importance" compared to a project report reflects a fundamental shift in the Indian economic and credit landscape. While the statement oversimplifies a complex evolution, it captures a kernel of truth: the sufficiency of CMA data as a standalone appraisal tool has diminished, compelling its integration into a more holistic and forward-looking assessment process.

Acknowledging the Limitations of a CMA-Centric Approach

The traditional, CMA-heavy approach to credit appraisal has several inherent limitations that have become more pronounced in a dynamic economy:

- Historical Bias: The CMA report is heavily anchored in past financial data. This makes it an inadequate tool for appraising new ventures, startups, or companies in disruptive industries where historical performance is either non-existent or a poor predictor of future success.

- Susceptibility to "Window Dressing": The purely quantitative nature of the CMA makes it vulnerable to manipulation. Companies may engage in "window dressing"-artificially boosting sales or delaying payments near the end of a reporting period-to present a deceptively healthy financial picture in their statements. This practice can mask underlying financial weaknesses and mislead lenders who rely solely on the reported numbers.

- Inherent Flaws of Ratio Analysis: While useful, financial ratios can be misleading without proper context. They ignore crucial qualitative factors like the quality of management, brand strength, or disruptive industry trends. Furthermore, ratios can be distorted by differing accounting policies between firms, the effects of inflation on historical costs, and may not reveal the full story behind the numbers.

- Regulatory Caution: Even the RBI has implicitly acknowledged these limitations, advising banks not to rely solely on CMA data when making lending decisions, thereby encouraging a more comprehensive due diligence process.

The Post-1997 Shift: From Mandate to Practice

A pivotal moment in this evolution occurred in April 1997. As part of the broader financial sector reforms and economic liberalization, the RBI officially withdrew all instructions related to the mandatory assessment of working capital based on the Tandon Committee's MPBF framework. Banks were granted the freedom to develop and implement their own credit appraisal methodologies, such as the Turnover Method for smaller SSI units or the Cash Budget Method for businesses with high seasonality. Despite this regulatory freedom, the CMA format and the underlying principles of the Tandon and Chore committees have largely persisted in banking practice. This endurance is due to a combination of institutional familiarity and the format's undeniable utility as a comprehensive and structured analytical tool that had become deeply embedded in the credit culture of Indian banking.

The Rise of the Holistic Appraisal: Recontextualizing CMA's Importance

The perceived decline in the CMA's importance is a direct consequence of India's economic liberalization. In the pre-1991 protected economy, where market conditions were relatively stable, past performance was a reliable guide to future prospects. However, in the post-liberalization era, characterized by intense competition, technological disruption, and global integration, a company's future success hinges more on its strategic agility, market positioning, and innovative capacity-factors best articulated in a Project Report-than on its historical financials alone. Therefore, the modern appraisal process has evolved into a balanced scorecard. The CMA report provides the essential quantitative foundation, verifying the company's financial discipline and historical performance. The Project Report, however, supplies the critical strategic context, market validation, risk analysis, and forward-looking narrative. The CMA's importance has not declined, but its role has been recontextualized. It has transitioned from being the primary, and often sufficient, basis for a credit decision to being a necessary but not sufficient component of a broader, more sophisticated due diligence process.

The FinTech Disruption and the Future of Credit Appraisal

The ongoing FinTech revolution is introducing the next phase in the evolution of credit appraisal, further augmenting and, in some cases, challenging the traditional CMA-based model.

- Alternative Data and AI/ML Models: FinTech lenders are pioneering the use of Artificial Intelligence (AI) and Machine Learning (ML) algorithms to analyze vast amounts of non-traditional or "alternative" data. This includes GST returns, bank account transaction data, utility bill payments, mobile phone usage patterns, and online commercial activity. This approach is particularly powerful for assessing the creditworthiness of MSMEs and new-to-credit borrowers who lack the formal, audited financial history required for a traditional CMA report. This represents a fundamental philosophical shift in credit assessment-from relying on what a company formally reports to analyzing what its real-time data trail reveals.

- Expected Credit Loss (ECL) Framework: The regulatory push towards the ECL framework for loan loss provisioning is compelling banks to adopt more dynamic and forward-looking risk models. This framework requires banks to estimate potential future losses rather than providing for losses only after they have occurred, further reducing the reliance on purely historical data.

This technological advancement places the CMA report as one important data source within an increasingly complex and data-rich credit risk management ecosystem, where it is supplemented by real-time analytics and predictive modeling.

Strategic Recommendations for Loan Applicants

For businesses seeking financing in the current environment, understanding the evolving dynamics of credit appraisal is crucial. Success depends on presenting a cohesive and credible narrative that satisfies both the quantitative rigor of the CMA and the strategic scrutiny applied to the Project Report.

Crafting a Cohesive Financial Narrative

The most critical element is ensuring consistency between the CMA data and the Project Report. The assumptions that underpin the financial projections in the Project Report-such as sales growth, profit margins, and working capital cycles-must be logically derived from and consistent with the historical trends revealed in the CMA. Any significant positive deviation, such as a "hockey-stick" sales projection, must be explicitly and robustly justified within the Project Report through detailed market analysis, capacity expansion plans, or new strategic initiatives. A disconnect between the two documents is a major red flag for lenders.

Beyond the Numbers: Justifying Projections and Assumptions

Lenders now scrutinize the 'why' behind the numbers more intensely than ever before. Applicants must move beyond mere arithmetic projections. Every key assumption must be substantiated. For instance, projected sales growth should be supported by credible market research, analysis of industry trends, and a clear sales and marketing strategy. Similarly, projected profit margins should be defended with a detailed cost analysis and pricing strategy. Unrealistic, overly optimistic, or unsubstantiated assumptions are among the most common reasons for the rejection of loan proposals, as they undermine the credibility of the entire application.

Preparing for a Multi-faceted Scrutiny

Loan applicants must recognize that the appraisal process is no longer just a financial check but a comprehensive business audit. They must be prepared to defend their proposal on multiple fronts. This includes not only explaining and justifying the key ratios in their CMA data but also articulating their business model, the expertise of their management team, their competitive advantages, and the risk mitigation strategies outlined in their Project Report. Lenders are assessing the project's viability and the promoter's capability in tandem. A successful applicant demonstrates mastery of both the financial details and the strategic vision.

Conclusion

Synthesizing Past, Present, and Future of Credit Appraisal in India

The Credit Monitoring Arrangement (CMA) data framework represents a pivotal chapter in the history of Indian banking regulation. Conceived from the seminal recommendations of the Tandon and Chore Committees, it successfully replaced the cumbersome Credit Authorisation Scheme, ushering in an era of disciplined, need-based lending and delegating appraisal authority to banks. For decades, its standardized format has served as the bedrock of quantitative financial analysis, creating a common language for risk assessment across the nation. However, the economic landscape in which the CMA was born has transformed. The forces of liberalization, globalization, and technological disruption have necessitated a more forward-looking and holistic approach to credit appraisal. Consequently, the role of the CMA has evolved.

Think of it this way: CMA Data is the engine of your financial proposal, but the Detailed Project Report is the entire car. You need the whole car to reach your destination.

It is no longer the sole arbiter of creditworthiness but a vital and indispensable component of a broader due diligence framework. The modern credit appraisal process does not view the CMA data and the Project Report as competing documents but as essential, complementary tools. The CMA establishes the borrower's financial foundation, providing empirical evidence of past performance and financial discipline. The Project Report, in turn, articulates the future vision, assessing the strategic, technical, and commercial viability of the proposed venture. In the current era, the CMA provides the proof of concept, while the Project Report provides the blueprint for growth. As the Indian banking sector continues to integrate advanced analytics, alternative data, and predictive modeling, the appraisal process will only become more sophisticated. In this dynamic future, the CMA will endure not as a relic, but as the foundational quantitative record upon which modern, data-rich, and strategically-focused credit decisions are built.

All material on this website is provided for educational and financial awareness purposes only and is not meant to be copied, used, or reproduced by anyone in any way. This material is copyrighted and protected under relevant Indian laws, including the Information Technology Act, as well as international copyright law. The protection of our intellectual property is taken very seriously, and any unauthorized use and/or duplication of this material is strictly prohibited.